Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Saturday, October 14, 2006

What's Berkshire Hathaway Worth, Anyway?

This past week Berkshire Hathaway Class A common stocks briefly traded above $100,000 per share. Yes, indeed, 10 shares of Warren Buffett's pride and joy makes you a millionaire. Mr. Buffett the, "Oracle of Omaha" has given us professorial lectures for 30 years in his annual reports as to how to value the stock of Berkshire Hathaway. For 30 years, Wall Street has ignored him. According to Zacks, only two analysts make earnings estimates for the stock and both are very wide of the mark.

From time to time, someone will value Berkshire Hathaway Class A stock by valuing the sum of its parts. Berkshire is essentially a holding company of many disparate and independent companies. By individually valuing each company relative to like companies that trade in the open market, one should be able to get a reasonably good idea what the stock is worth. I think there is a better way.

Berkshire Hathaway is the only non-dividend paying stock that we have bought in years. (See our general dividend theory) The reason is simple: even though Buffett eschews dividends (we've asked him to change)by listening to his annual-report lectures, we believe he's right about how to value the stock: book value.

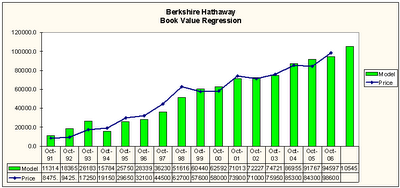

BRK/A almost defies normal valuation because of the complexity of the wide range of companies it owns and the lumpiness of its results, as a result of its insurance business. But Buffett's insistance on high quality companies with strong cash flows lends itself to valuing the stock using book value and interest rates. The chart below is a multiple regression of BRK's book value and long-term interest rates versus it price.

....................Berkshire Hathaway Valuation.............

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.